How I value mergers and acquisition deals

Hi everyone! In this post I'll show you how I valuate mergers and acquisitions and other special situation investments. I started doing this after reading You can be a stock market genius by Joel Greenblatt. Despite the clickbait title, this is a really good book about special situation investing.

This post is a write-up about the merger between US supermarkets Kroger ($KR) and Albertsons Companies ($ACI). I describe how I found about a new merger, what sources I used to find more information, and how I did computations to assess whether it might be a good investment. It involves quite some numbers, but don't worry, if you can multiply and divide, you have all the math you need to understand this post. Note that this is only a rough back-of-the-envelope calculation. The numbers are all estimates, but it gives me a good enough indication of the upside and downside of an investment.

And finally: this is not investment advice, or an endorsement of the companies I mention here. Educate yourself, do your own research, and have fun.

My first experience with risk arbitrage

My first experience with investing in a merger was the Fiat -- Peugeot merger deal in 2019/2020. I had just started stockpicking and I was looking into companies with low Price-to-Earnings (PE) ratios. The car industry is highly cyclical, which means that the stock prices go up and down with the economic cycle, and Fiat was trading for 2-5 times their yearly earnings at the time. After doing some research, which means reading a few press releases and doing basic math, I decided to buy shares in Fiat. According to my computations, I would spend a few euros per Fiat share, and I would receive that same amount per share (plus I would get keep the share I bought!) from Fiat once the deal was completed, some 12 months into the future. This hypothesis turned out to be right, which led to my first doubled investment (+100%).

Finding out about the Kroger -- Albertsons merger

Today I looked into the Kroger -- Albertsons merger, which I encountered by accident. I was browsing the website of financial magazine Barron's, searching for articles with 'takeover' or 'acquisition' in the title. Since I own some Kroger shares, my interest was piqued.

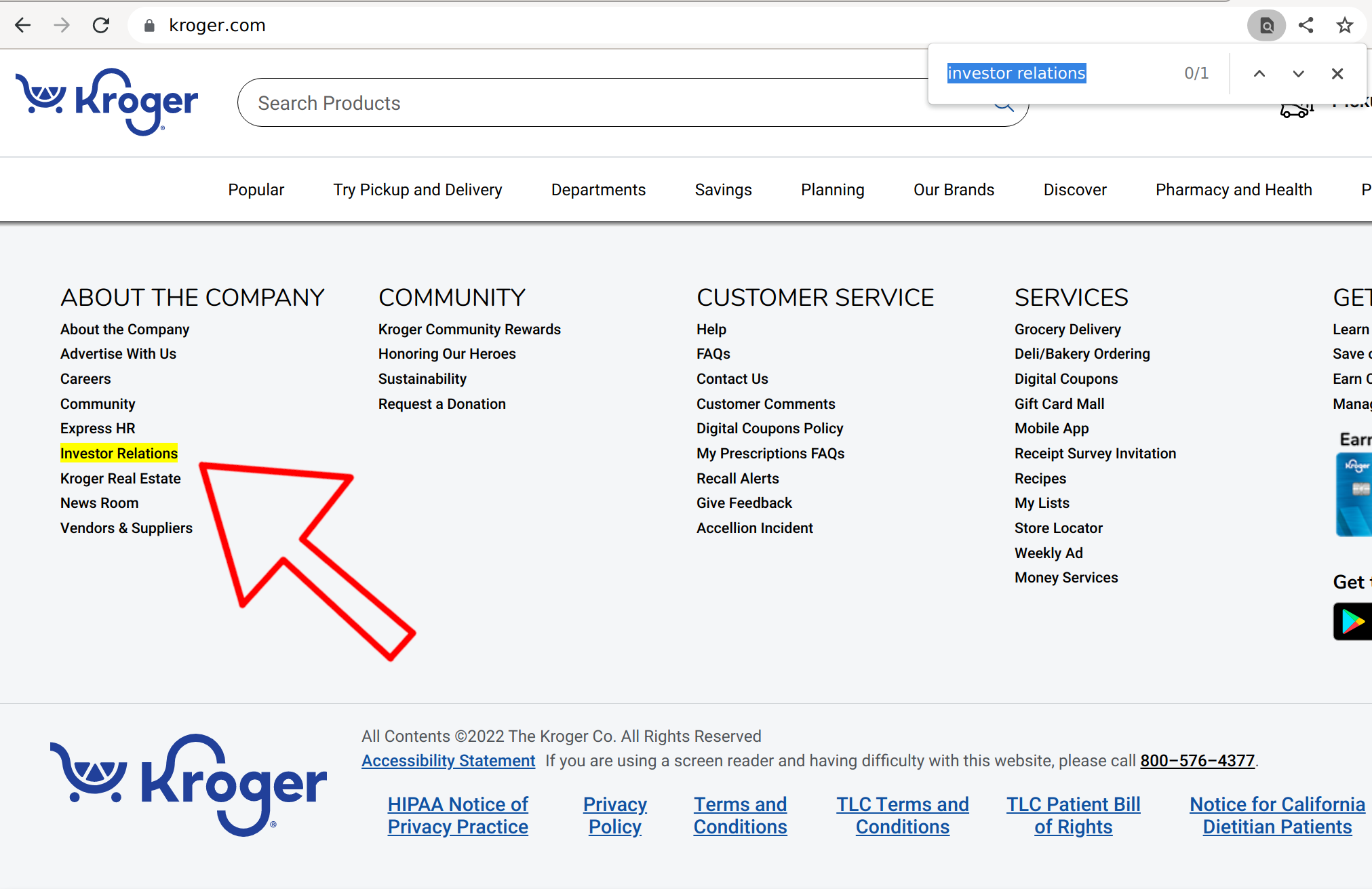

I am no longer a Barron's subscriber so I couldn't read the article itself, but I know that companies are legally obliged to make all information related to mergers and acquisitions public on their Investor Relations website. You can find these (gasp!) by googling the company name + "investor relations", or search the corporate website of a public company.

I googled around for more news articles about the deal, and found another article on Barron's website:

Barron's: Judge pauses Albertsons 4 billion special dividend payout

Collecting facts

News websites

Once I'm interested in a specific deal, I start collecting facts. I always by looking up a few news articles on Yahoo Finance, Barron's, the Wallstreet Journal website, MarketWatch, etc. This is much more efficient than immediately diving into the formal SEC forms and other official documents.

From the Barron's articles I could gather the following:

- Kroger will pay 34.10 USD in cash for Albertsons shares, which are now trading for about 21 USD.

- A US judge temporarily stopped the payment of Albertsons "special dividend"

Investor's Relations websites

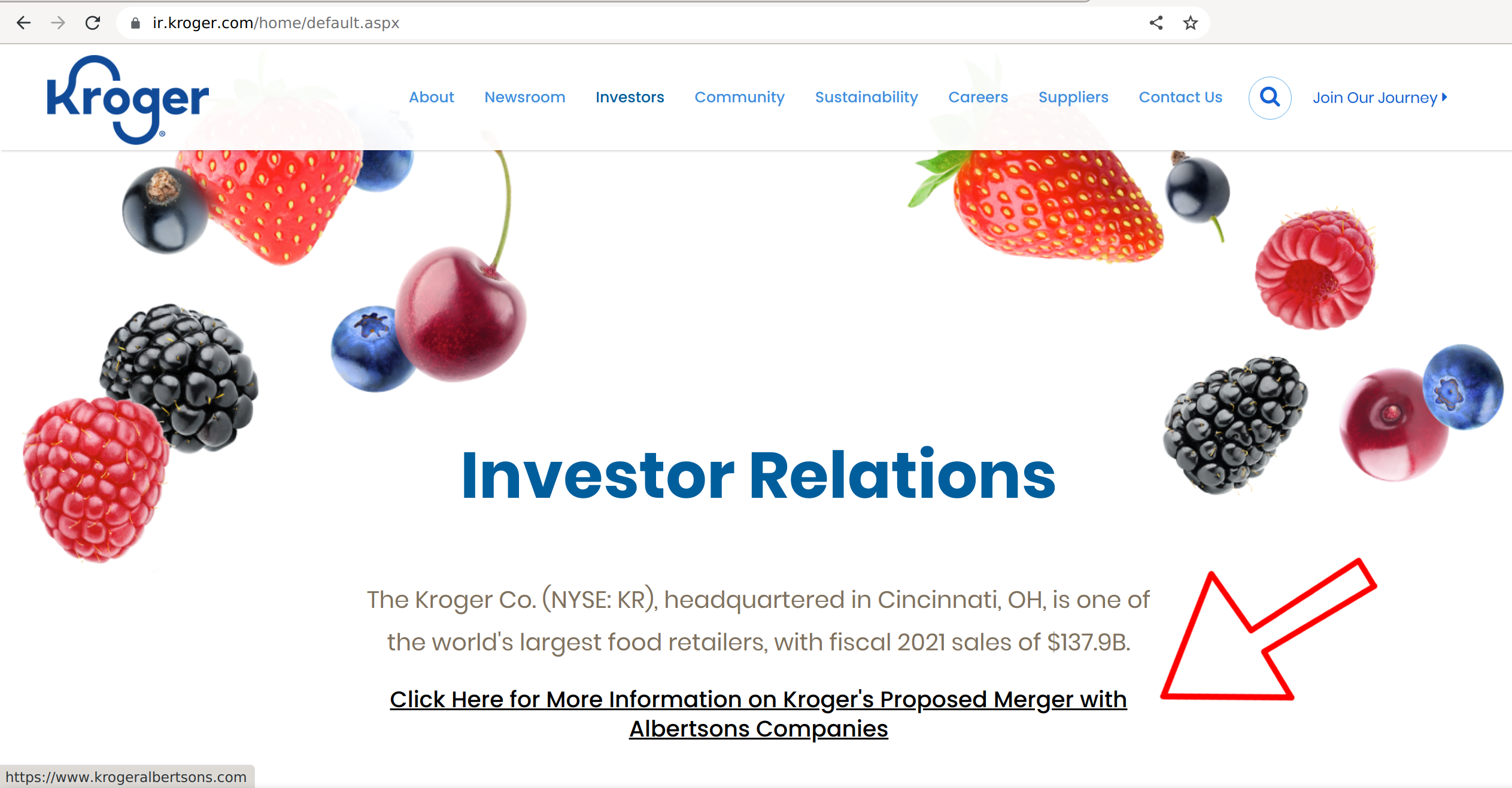

More information about the merger is really easy to find on Kroger's investor relations page:

Here we can collect more facts:

- Albertsons is planning on paying a special dividend of 4 billion USD to shareholders, which was planned for November 4, 2022.

- The transaction is expected to close in early 2024. Let's presume that's March 2024 at the latest. Then the runtime for this deal is March 2024 minus November 2022 = 17 Months

- 34.10 (cash offer) / 21 (current stock price of Albertsons) = 1.62, or 62% profit in 17 months. Not bad.

- a 4 billion dividend divided by 11 billion market cap worth of shares means a 36% dividend: 4 billion / 11 billion = 1.36. The market cap of 11 billion I found on the Yahoo Finance homepage for Albertsons.

I wanted to learn more about the special dividend. It was paused by the judge, can I still participate? Was it cancelled? Would someone need to own the shares on a specific date to qualify for the special dividend?

On the Albertsons IR website, we can find this:

"Subject to the outcome of a store divestiture process, the cash component of the $34.10 per share consideration may be reduced by the per share value of a newly created standalone public company ("SpinCo") that Albertsons Cos. is prepared to spin off at closing in conjunction with the regulatory clearance process described further in the Transaction Details below. As part of the transaction, Albertsons Cos. will pay a special cash dividend of up to $4 billion to its shareholders. The cash component of the $34.10 per share consideration will be reduced by the per share amount of the special cash dividend, which is expected to be approximately $6.85 per share. This cash dividend will be payable on November 7, 2022, to shareholders of record as of the close of business on October 24, 2022."

From this piece of text I could gather more facts:

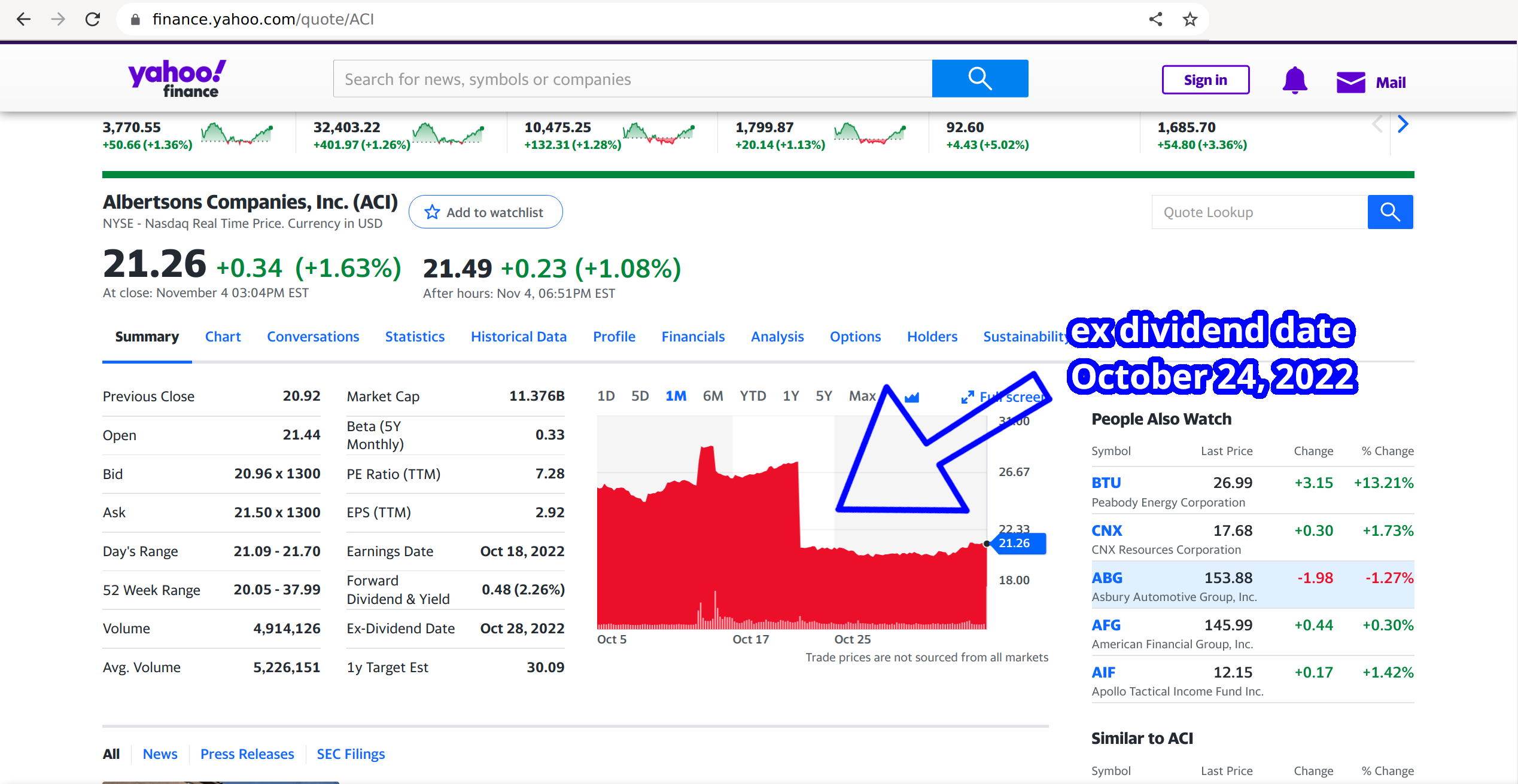

- It's November 6, so I am not eligible for the special dividend. I should have owned shares on October 24 at the latest.

- the special dividend should be about 6.85 USD.

- the special dividend will be subtracted from the cash offer for Albertsons shares, so that's 34.10 USD - 6.85 USD = 27.25 USD per share.

- the merger deal is subject to anti-trust regulations. I think this means that Albertsons and Kroger are not allowed to merge if that leads to a monopoly type situation where competitors no longer stand a fair change. Kroger and Albertsons are planning to spin off (divest) some of their stores into a spin-off company, which will continue as an independent public company. "SpinCo" is the working title for this spin-off. Albertsons shareholders will receive shares of this spin-off company, and the value of those shares will be subtracted from the 34.10 as well.

Since the current stock price of Albertsons is only 21 USD, does the market think that the spin-off company will be worth 34.10 cash - 6.85 special dividend = 6.25 USD per share?

The spin-off

Let's find more information about this spin-off. There are two other interesting bits of text on the IR website:

The per share cash purchase price payable to Albertsons Cos. shareholders in the merger would be reduced by an amount equal to (i) three times four-wall adjusted EBITDA for the stores contributed to SpinCo divided by the number of Albertsons Cos. common shares (including common shares issuable upon conversion of Albertsons Cos.' preferred stock) outstanding as of the record date for the spin-off plus (ii) the per share amount of a special pre-closing cash dividend of up to $4 billion payable to Albertsons Cos. shareholders, which is expected to be approximately $6.85 per share. This cash dividend is expected to be payable on November 7, 2022, to shareholders of record as of the close of business on October 24, 2022.

and

"In connection with obtaining the requisite regulatory clearance necessary to consummate the transaction, Kroger and Albertsons Cos. expect to make store divestitures. As described in the merger agreement and subject to the outcome of the divestiture process, Albertsons Cos. is prepared to establish an Albertsons Cos. subsidiary (SpinCo). SpinCo would be spun-off to Albertsons Cos. shareholders immediately prior to merger closing and operate as a standalone public company. Kroger and Albertsons Cos. have agreed to work together to determine which stores would comprise SpinCo, as well as the pro forma capitalization of SpinCo. The establishment of SpinCo, which is estimated to comprise between 100 and 375 stores, would create a new, agile competitor with quality stores, experienced management, operational flexibility, a strong balance sheet, and focused allocation of capital and resources to provide customers with continued value and quality service and associates with ongoing compelling career opportunities."

I tried to figure out what the spin-off could be worth by combining numbers from these paragraphs.

Facts:

- the spin-off will be comprised of 100 to 375 stores.

- the spin-off will be valued at 3x adjusted EBITDA (Earnings Before Interest Taxes, Depreciation and Amortization) of those stores.

We don't know which stores will be transferred to the spin-off company, but they will be Albertsons stores. So what is the EBITDA of an average Albertsons store?

I took a look at the last annual report (or "form 10-K") filed by Albertsons to get more information about this. You can find these reports by going to EDGAR, the official database of the US Securities and Exchange commission.

EDGAR: Albertsons Companies, Inc

"As of February 26, 2022, we operated 2,276 stores across 34 states and the District of Columbia under 24 banners including Albertsons, Safeway, Vons, Pavilions, Randalls, Tom Thumb, Carrs, Jewel-Osco, Acme, Shaw's, Star Market, United Supermarkets, Market Street, Haggen, Kings Food Markets and Balducci's Food Lovers Market. Additionally, as of February 26, 2022, we operated 1,722 pharmacies, 1,317 in-store branded coffee shops, 402 adjacent fuel centers, 22 dedicated distribution centers, 20 manufacturing facilities and various digital platforms."

"Adjusted EBITDA was $4,398.4 million, or 6.1% of Net sales and other revenue, during fiscal 2021 compared to $4,524.0 million, or 6.5% of Net sales and other revenue, during fiscal 2020."

Facts:

- Albertsons has 2,276 stores, with a combined adjusted EBITDA of 4398 million USD in 2021.

Some estimates:

- 4.3 billion EBITDA divided by 2276 stores means 1.8 million USD on average per store.

- in case of 100 stores in the new spin-off: 3x 100 stores * 1889279 = 566 million

- in case of 375 stores in the new spin-off: 3x 375 stores * 1889279 = 2.1 billion

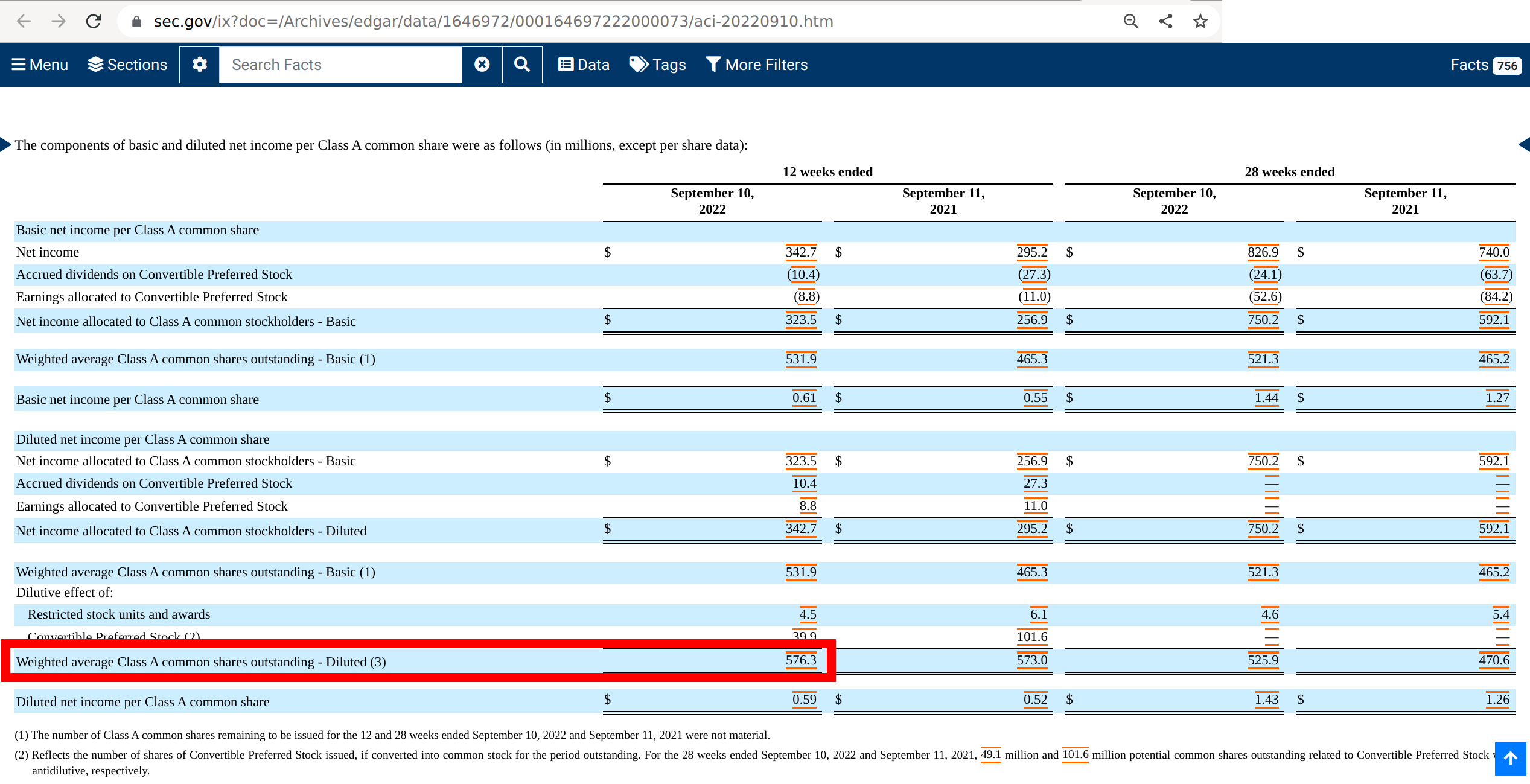

We need to divide the spin-off value by the number of Albertsons Cos. common shares (including common shares issuable upon conversion of Albertsons Cos.' preferred stock) outstanding as of the record date for the spin-off.

For a current count of the outstanding shares, I'm looking at the last quarterly report (or "form 10-Q") of Albertsons, also in EDGAR.

"The Company calculates basic and diluted net income per Class A common share using the two-class method. [...] Diluted net income per Class A common share is computed based on the weighted average number of shares of Class A common stock outstanding during each period, plus potential Class A common shares considered outstanding during the period, as long as the inclusion of such awards is not antidilutive. Potential Class A common shares consist of unvested restricted stock units ("RSUs"), restricted common stock ("RSAs") and Convertible Preferred Stock, using the more dilutive of either the two-class method or as-converted stock method. Performance-based RSUs are considered dilutive when the related performance criterion has been met."

From the nearby table, I gather that the number of diluted Class A common shares was 576.3 million on September 10, 2022.

More estimates:

- In case of 100 stores in the spin-off, the spin-off will be valued at 566 million EBITDA / 576.3 million shares = 0.98 USD per share

- In case of 375 stores in the spin-off, the spin-off will be valued at 2100 million EBITDA / 576.3 million shares = 3.64 USD per share

- Interestingly, Albertsons is currently valued at about 7 times it's EBITDA per share: 4398 EBITDA / 576.3 shares = 7.63 EBITDA per share. The current stock price is 21 USD, so the price-to-EBITDA ratio is about 3, just like the future spin-off!

Conclusion

Conclusion: if I want to participate in the spin-off, I can buy shares in Albertsons tomorrow for 21.50 USD per share. If everything goes according to plan, in spring 2024 I will get:

- 0 USD special dividend

- 1 share of the spin-off (estimated valued at 1.00 to 3.64 USD)

- 27.25 USD minus the value of the spin-off share

So is this riskless investment? Free money?

Certainly not. There are many reasons a deal can fall through, such as shareholders (of either company), activist investors, a third-party, legal disputes and anti-trust laws. You only need to read the articles about Elon Musk's takeover of Twitter to know that mergers and acquisitions can be rollercoasters.

Investing in mergers and acquisitions is sometimes called risk arbitrage. As investor, you take the risk that the deal doesn't close, and in return, you get the computed amount as reward if everything goes as planned.

So what can go wrong? What is the downside?

If the deal falls through for whatever reason, an acquired company's stock price might sink to the level is was trading on the day the deal was announced. In Albertson's case this was October 14, 2022. However, at that time the stock was trading for 24 dollar, which is higher than the current amount. The stock price dropped dramatically on the "ex-dividend date", the deadline for being eligible for the special dividend.

It could also be that the share of the spin-off is worthless, or worth much less than the assigned value of 3x EBITDA. This can happen if Albertsons and Kroger decide to spin-off the worst performing supermarkets. If I want to be conservative, I can value the spin-off share at 0 USD. Then the worst case up-side of buying a 21.50 USD share is 34.10 - 6.85 special dividend - 3.64 spin-off share price = 23.61. This translates into a profit of 23.61 / 21.50 = 1.098, or about 10 percent, over 17 months. It's not too bad, but it's also not great.

I think the upside on this deal is not enough for me to participate, but I enjoyed the necessary detectivework nevertheless. If you've made it until here, well done. I think this is my longest blogpost yet. I hope you found this write-up interesting!